Domino’s focuses operations, targeting ~$55m improvement in annualised underlying performance

Domino’s Pizza Enterprises Ltd intends to exit the Danish market, reduce the corporate store network, and streamline core operations to leverage global reach and scale.

Domino’s Pizza Enterprises Ltd (Domino’s) has taken steps to deliver material, near-term, cost savings, improving efficiency and building a stronger foundation for future growth.

Immediate outcomes include initiating a process of closing Domino’s 27 stores in Denmark and optimising the corporate store network, through accelerated refranchising and closing ~65-70 underperforming corporate-owned stores. The closures represent ~2.0% of Domino’s global footprint of 3827 stores.

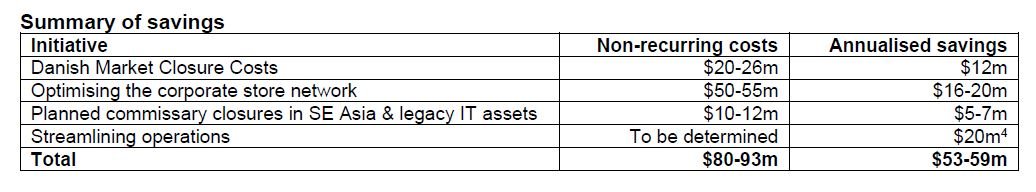

The combined savings will improve FY24 EBIT by ~$25-30m, with these savings expected to increase over the next two years as initiatives are completed. Non-recurring costs in FY23 of $80-93m EBIT are expected.1

Domino’s today reported Same Store Sales have improved this quarter (+3% excluding Taiwan), with the Company and franchisees focused on growing weekly order counts to deliver stronger store profitability.

Notwithstanding these recent improvements, there has been a slower than anticipated rebuilding of weekly order counts, largely delivery orders. Accordingly, underlying H2 EBIT2 growth, has not improved on H1 performance.

Domino’s intends to deliver materially higher profitability in FY24 and the medium term, both through an improvement of the core business, delivered through higher sales, and initiatives including:

Commenced a process to exit the loss-making Danish market by end of FY23 – the market was acquired for €2.5m in a receivership process from the former owners in 2019. Performance in this small market since has not materially improved. The closure will deliver $12m in immediate EBIT improvement.

Optimising the corporate store network – Domino’s will reduce the size of its current corporate store network (~913 stores) by ~15-20%, through closing underperforming stores and accelerating the refranchising of corporate store in ‘turnaround’.

Approximately 65-70 underperforming stores (less than 2% of the Global network) open for some time but not expected to reach sustainable levels of sales or profitability in the near term, will close

Domino’s will partner with experienced franchisees to franchise ~70-75 corporate stores that are in ‘turnaround’. This will reduce DPE’s operating costs required to improve these stores, with a potential initial investment cost required by DPE

Domino’s expects to deliver annualised savings of $16m-20m through this optimisation; completion anticipated H1 24.

Delivering on planned commissary closures in South-East Asia and legacy IT assets – the commissary closures, which were planned as part of the acquisition integration for Taiwan, Malaysia, Singapore, and Cambodia, will improve product quality, supply chain resilience and reduce costs. With all geographies successfully integrating onto the new generation OLO during the year, the useful life of legacy assets has been shortened resulting in accelerated amortisation of $7m, benefiting both DPE and National Advertising Funds.

The commissary closures and the accelerated amortisation of legacy assets is estimated to deliver annualised EBIT savings of $5m–$7m.

Streamlining core operations – Domino’s is reviewing business units to identify efficiencies, including realignment of business structures, simplification of systems and removal of operational areas that are not core to our future growth. Immediate changes include the closure of our Construction and Supply subsidiary in Australia. Ongoing savings will increase as the streamlining continues to ~$20m EBIT savings from FY25. The Company will provide an update on this review in August at the Full Year Announcement.

Group CEO & Managing Director Don Meij said: “Any inefficiency is a burden on the system as a whole; streamlining our business allows our franchisees to focus on delivering the best possible customer experience, growing sales and profitability, and expanding their business.

“The decisions of today will immediately deliver a stronger business and improve efficiencies for the long-term. As these initiatives are completed and deliver savings, we intend to reinvest approximately one third of these savings to stores, as we reinvest in the franchise network base.

“Domino’s Pizza Enterprises Ltd has a long-term plan, including building out the sizeable opportunity we have in Europe and the Asia-Pacific to more than double our business.

“This is the right time for us to redesign for future growth; we are taking deliberate action to bring more focus to our business, removing distractions and maximising the benefits of our global reach and scale.

Exiting the Danish Market

(FY24 saving: $12m EBIT | FY23 non-recurring closure costs $20-26m EBIT)

Domino’s Pizza Enterprises Ltd reopened the Danish market in 2019 from receivership. The previous owners breached public trust with food safety violations, highlighted in national media.

With Dominos track record, management had expected to repair the reputational position.

Europe CEO Andre ten Wolde paid tribute to the efforts of Domino’s Denmark’s leadership and team members.

“Our team in Denmark consistently delivered some of the highest quality operations not just in Domino’s, but in the QSR industry. Every store consistently had a ‘smiley’ (awarded by local authorities for high quality food safety and hygiene) and delivery times and product quality were second-to-none,” Mr ten Wolde said.

“While our team’s efforts won back some customers, and created loyal fans, the legacy of damage from the previous ownership was ultimately too great for us to overcome in the foreseeable future.

“We are immensely proud of our team’s hard work, and I am only disappointed that we will not be able to share the joy of Domino’s experience, and the opportunities that creates for team members.”

Optimising the corporate store network

(Annualised saving: ~$16-20m EBIT| FY23/FY24 non-recurring costs ~$50-55m EBIT)

Group CEO & Managing Director Don Meij said the closure of a small proportion of corporate-owned stores with very low average weekly sales would help build a stronger global network.

These ~65-70 stores have typically operated for some time and in some cases were part of an acquisition. These stores have taken longer to reach sustainable levels of sales than originally anticipated.

“Making the decision to close any store is a difficult one, but for these stores it is the right one.

“The investment and focus required is a drag on neighbouring stores and a distraction for the system.

“Where we remove inefficiencies in stores, or in our business, we all benefit from higher sales and faster growth: we expect our neighbouring stores to benefit from this opportunity.”

Domino’s Pizza Enterprises Ltd will continue to sell corporate stores to franchisees where it is expected a franchisee will deliver higher growth as part of their long-term expansion plans.

Domino’s has historically refranchised stores to protect the brand, or for strategic reasons including optimising local delivery territories. This process frequently involves additional operating and capital costs as part of the store turnaround.

The Company will accelerate this process by working with high-performing franchisees eager to expand their businesses by taking on these turnaround stores.

Domino’s operating expenses will reduce from FY24 through this process, forgoing the anticipated profit on sale of ~70-75 stores that would otherwise be achieved in 2-3 years.

Delivering on planned commissary closures in South-East Asia and legacy IT assets

(Annualised saving: ~$5-7m | FY23/FY24 non-recurring costs $10-12m)

APAC CEO Josh Kilimnik said the closures of commissaries in South-East Asia, acquired as part of the acquisition, would deliver not only an immediate saving for DPE and stores, but also improve supply chain resilience and product quality.

“When acquiring the Domino’s businesses in Taiwan, Malaysia, Singapore and Cambodia, we identified the opportunity to close these facilities and move to in-store dough making, rather than making dough in a centralised facility and shipping this to stores.

“After extensive testing and roll-out in Japan, using the deep experience in other markets such as ANZ, we are pleased we can move to in-store doughmaking in all Asian markets. Taiwan has recently been completed.

“As a result, we will close the commissaries in Malaysia and Singapore, and move to distribute ingredients from partner warehouses – similar to the existing distribution model in Australia.

“This decision will provide customers a fresher, higher-quality product, reduce outages during high volume trading or extreme weather, and deliver savings for stores.”

With all geographies successfully integrating onto the new generation OLO during the year, the useful life of legacy assets has been shortened resulting in the accelerated amortisation of $7m.

The commissary closures and the accelerated amortisation of legacy assets is estimated to deliver annualised EBIT saving of between $5m – $7m, benefiting DPE and National Advertising Funds.

Streamlining core operations:

(Annualised saving: ~$20m3 | Non-recurring costs to be determined)

Mr Meij said: “As we advised at the Half Year results, we’ve challenged our teams in all markets to consider what will allow us to build our future in the fastest, most efficient, and sustainable manner.

“Wherever there is potential for reducing duplication, or achieving increased efficiencies, we will pursue these with continuous focus on delivering for our franchise network.

“When designing the Domino’s Pizza Enterprises Ltd for the future, we will leverage our scale and global footprint; aligning systems and processes to solve common problems, maximising the effectiveness of our investments.

“We will unify our businesses and ensure we can adopt best practices throughout the Group, just as our OneDigital online ordering system uses the same platform in our established markets.

“We have identified alternate ways to build and equip our stores and will be closing our Brisbane-based Construction and Supply Services subsidiary this month.

“With the acquisition of our newest markets, we have been undertaking extensive planning on how best to integrate all areas of the Group and share support to prepare for the next phase of our growth.

“Prior to the acquisition we identified the opportunity to share more services across the group, as we’ve traditionally done for smaller markets – we are actively progressing this.

Domino’s expects this streamlining program will deliver increasing efficiencies over the next two financial years, with ongoing savings of $20m annually from FY25.

Management will provide a program update, including FY24 savings, at the Full Year results in August.

Trading update

Group: H2 SSS +0.2% | Q4 SSS +2.0% | Excluding Taiwan: H2 SSS +1.0% | Q4 SSS +3.0%5

Organic new store openings for FY23, prior to corporate store closures, are expected to be ~6-7%.

Store openings in FY24 will be below the medium term outlook of 8-10%. No changes are planned to the long-term growth outlook for Domino’s network, of 7100 stores by 2033.6

Same Store Sales have improved through the Second Half. Despite the improving trend in Q4, Same Store Sales in FY23 remain below the medium-term outlook of 3-6% annual growth.

Domino’s is focused in all markets on increasing the number of delivery customers served each week.

“We know pricing is an important part of the value equation for our customers, but so is the quality of the pizzas we deliver and the time in which they safely arrive. These are the answers to growing weekly sales volumes and improving unit economics in the short-term, with incremental orders having a significantly higher contribution margin for franchisees.

“Higher volumes will deliver higher profitability and margins for our franchisees.

“With the decisions announced today we have stronger foundations in place and are dedicated to working closely with them to deliver short and long-term opportunities.”

This release has been authorised for release by the Board of Directors.

For further information, contact Nathan Scholz, Head of Investor Relations at investor.relations@dominos.com.au or on +614 1924 3517.

INDEX:

1 In addition, further non-recurring cost are anticipated in FY24, relating to streamlining of operations, which are to be determined

2 H2 23 underlying EBIT performance compared to pcp. H1 23 underlying EBIT -21.3% vs H1 22

3 The benefits of this initiative will be fully achieved over two years

4 The benefits of this initiative will be fully achieved over two years

5 As at 4 June 2023, noting Taiwan has been excluded from SSS calculations due to significant one-year variability following delayed lifting of COVID restrictions (October)

6 Domino’s Denmark was planned to add 150 stores to the global network by 2033. This has been removed from the long-term store outlook.